Automation is Progress

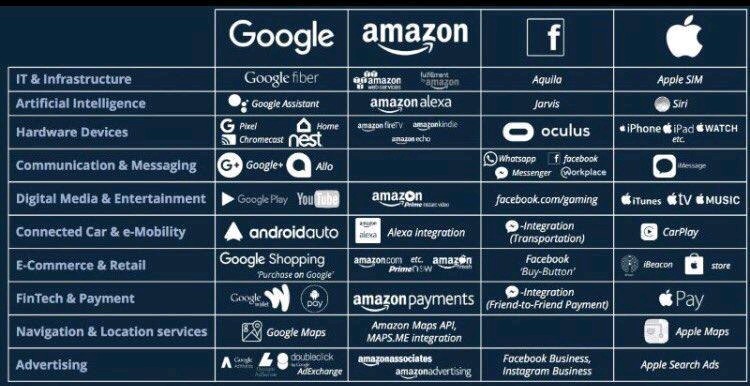

I’ve had a lot on my mind this season from climate change and wealth disparity (Robert Reich has great material worth watching/reading) to the implications of emerging technologies including:

- Mixed reality

- Deep learning

- Additive manufacturing

- Brain computer interfaces

- CRISPR

- Nanobots

- Computational biology

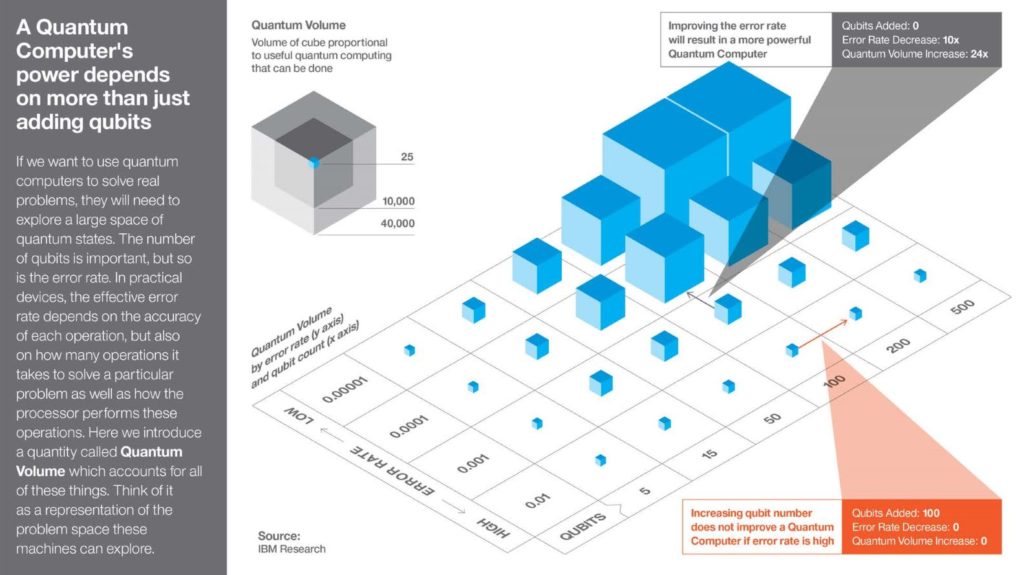

- Quantum computing

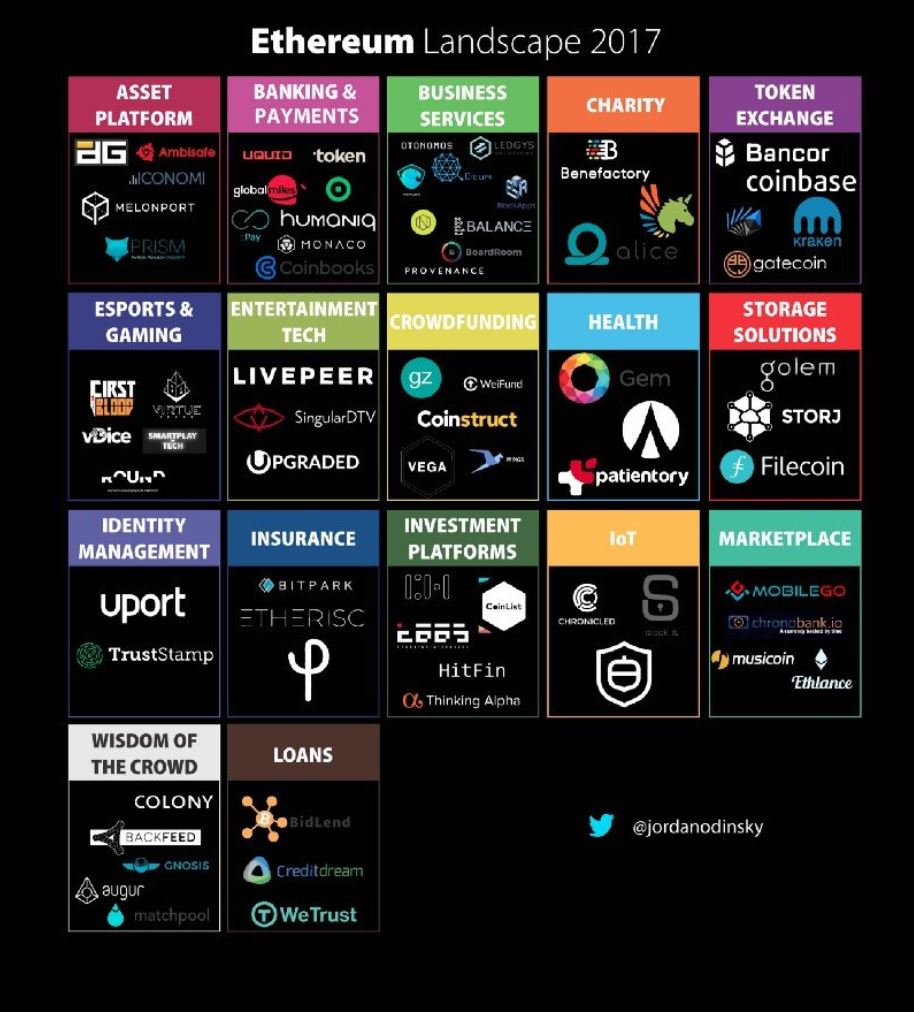

- Blockchain technology

- Smart cities

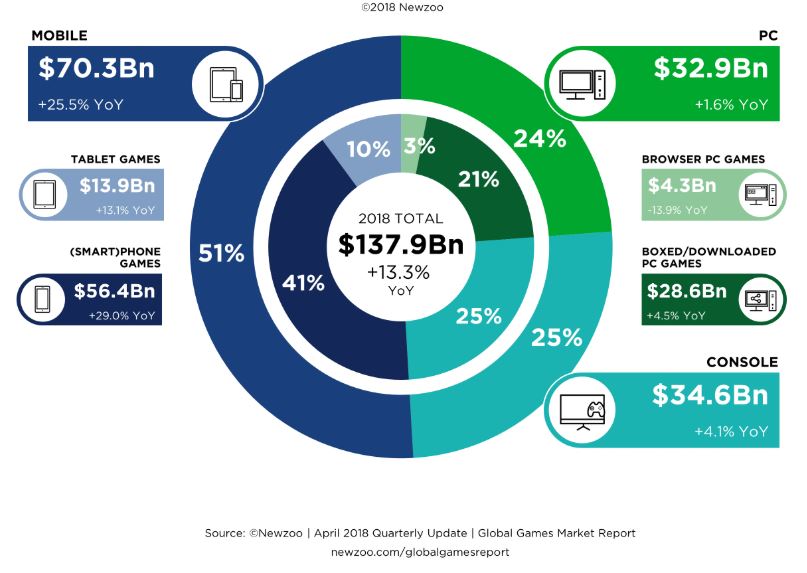

- Gaming as a service

- etc.

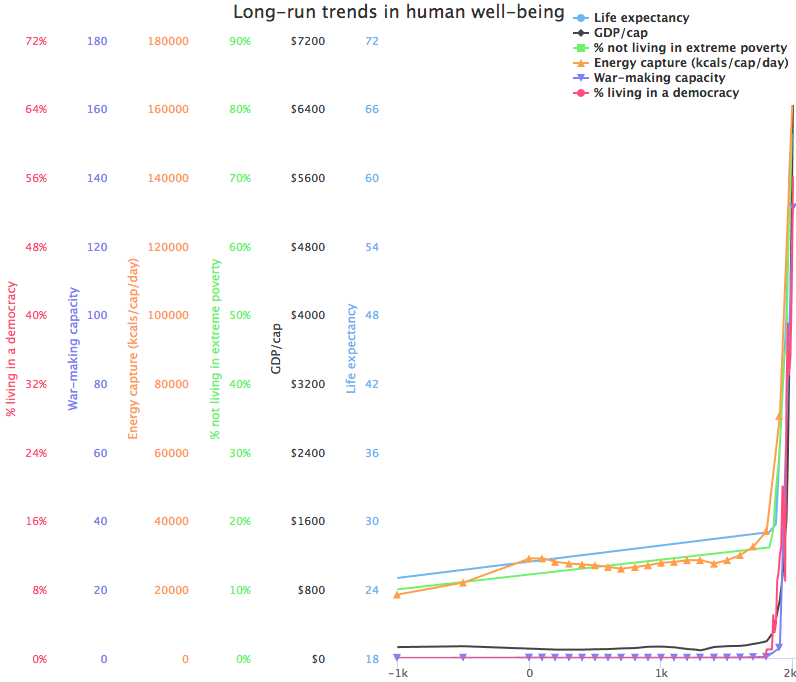

While these technological advancements are independently impressive in their respective attempts to fuel humanity’s ambitions, it is unlikely that any of them would have been possible if it were not for the Industrial Revolution which has served as a catalyst for contemporary society as we know it. The chart below from Luke Muehlauser’s blog showcases that humanity’s well-being has witnessed a drastic improvement since 1840, just after the Industrial Revolution. This conclusion is evident across six variables as seen on the y-axis including life expectancy, % not living in extreme poverty, and GDP.

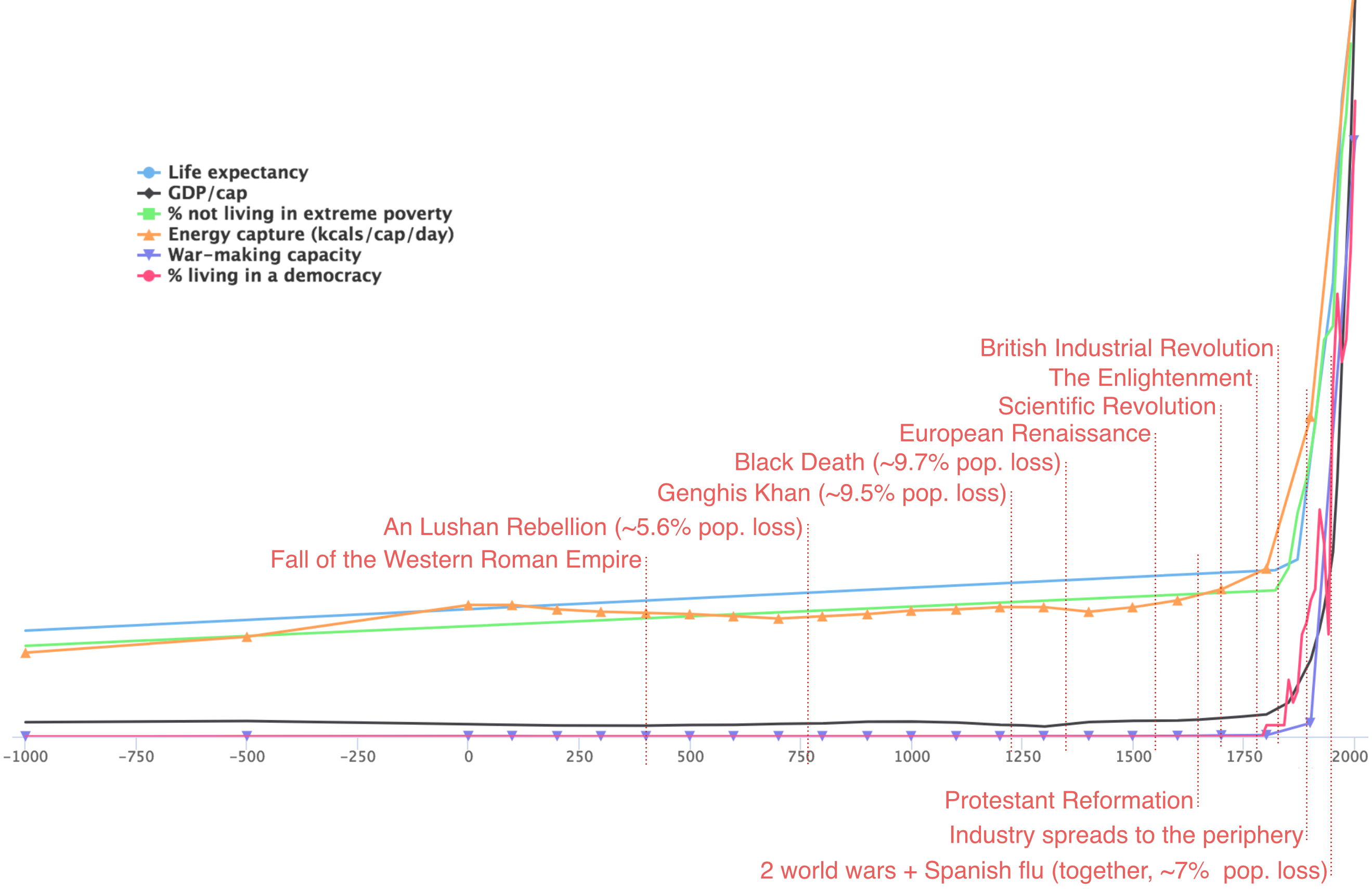

The aggregate scale of progress our species has made over the past ~180 years is truly awe-inspiring. To better depict the impression the Industrial Revolution has made relative to other world-changing events, let’s zoom in on the graph above and overlay a few events of historical importance. Assuming the y-axis remains static in the chart below, it’s clear that the Industrial Revolution has driven a magnitude of transformative change far greater than any other event in recorded history.

The Industrial Revolution, which lasted from ~1760-1840, established the factory system capable of transitioning production methods from the hands of workers to machines. In manufacturing any good, there are certain tasks that are easily repeatable and thus ripe for a machine to take over that does not tire. In essence, the Industrial Revolution led to early meaningful implementations of automation, but was constrained to manufacturing and process application. We define automation as a technique or method to control a process by automatic means. Ultimately, automation compounds efficiency wherever implemented with the goal being to reduce or replace the need for human intervention.

Artificial intelligence (AI) has become a progressively prominent enabler for the next generation of automation and its influence can be thought of on multiple levels akin to a sliding scale ranging from no automation to full automation as described below. (Source: Connell, M. L, Ph.D. 2019.)

- Manual: No automation. Everything is made by hand.

- Analog automation: Think early industrial era. Complex tasks performed by mechanical components gears, belts, cogs, etc. No real AI component.

- Single-task robotics: Think 1970’s automotive industry. A single-purpose robot built for a single well-defined task. Assembly lines of this age had to be amazingly precise since there was no controlling intelligence to error-correct.

- Single-task AI-enabled robotics: Similar to above, but with low-level AI programming able to error-correct within some parameters – this was a huge step forward. Emphasis still upon the individual robot being controlled. Characterized by a blend of mechanical and silicon (AI) controls and mechanisms.

- AI-enabled automation: Focusing more upon the software (AI) and taking the form of modular control apps applied to multiple situations and environments. Collaborative robots and enterprise SaaS today largely fall in this category of automation. Human intervention is limited to a managerial or oversight role.

- General AI automation: The machine/robot/software self-learns the principles of its environment. It is capable of determining and executing on any number of open-ended actions by problem solving as a human would. No human intervention beyond the decision to deploy is required.

(While we’re on the topic of General AI, let’s not forget to wish HAL from Arthur C. Clarke’s 2001: A Space Odyssey a happy birthday today!)

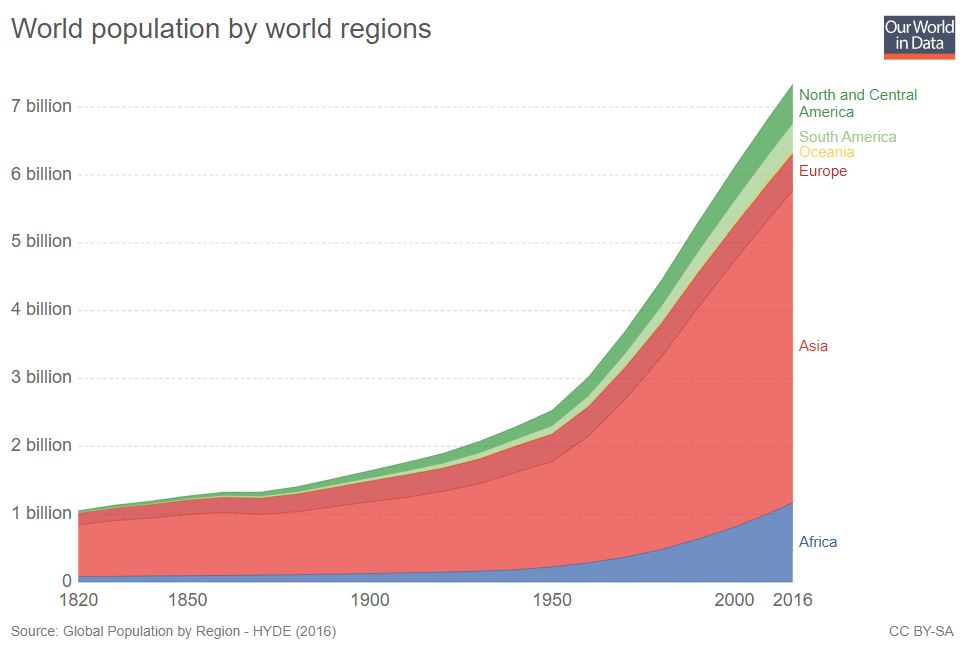

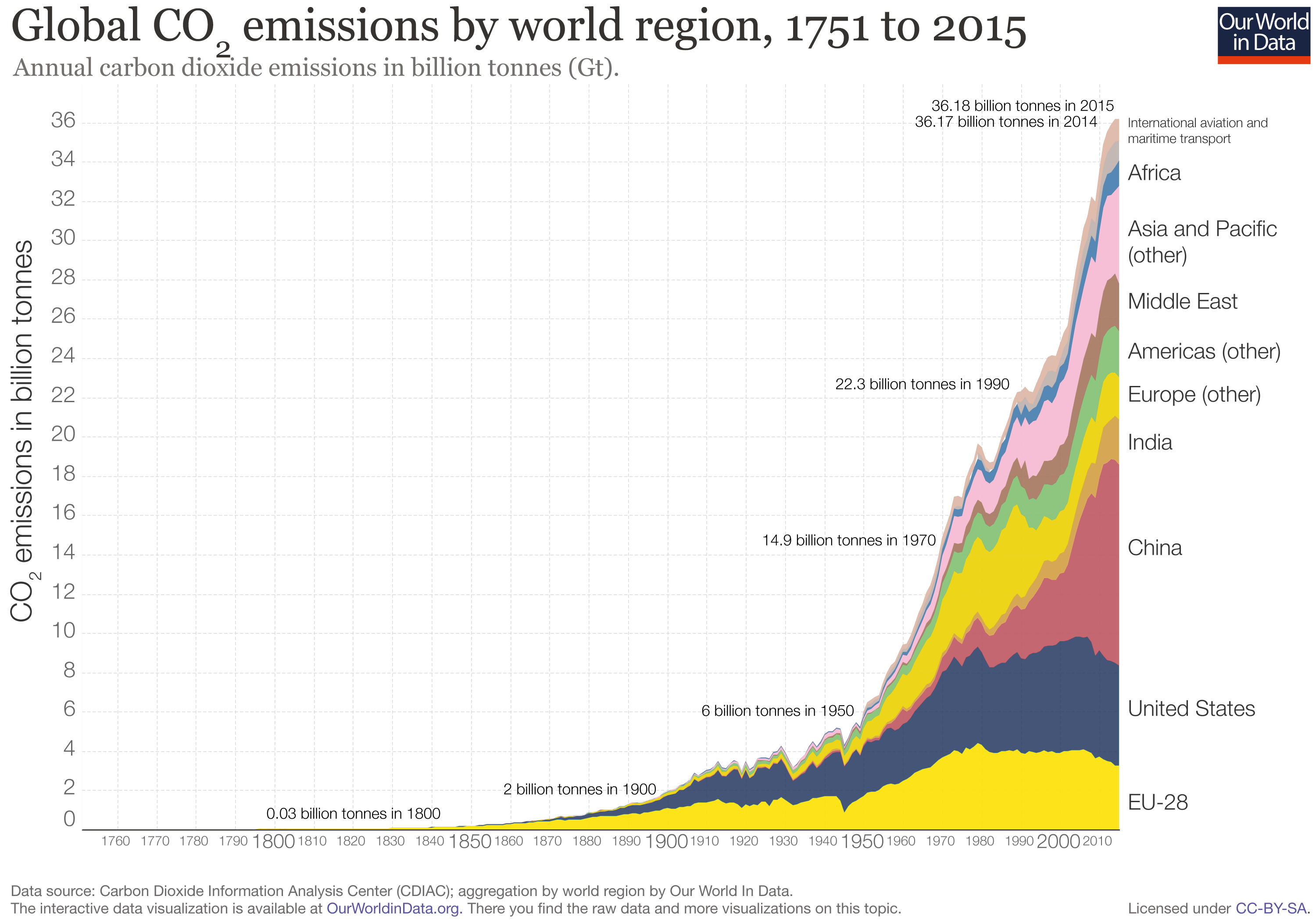

While automation has ushered in a new age of productivity, this increase in the global standard of living has come with baggage. Exponentially increasing population and an increase in carbon dioxide emissions are among many factors that future generations must address.

All of the above data points represent a small fragment of the grand narrative that is human progress, but point to a theme that has enabled us to thrive: automation.

Automation’s Impact on Society

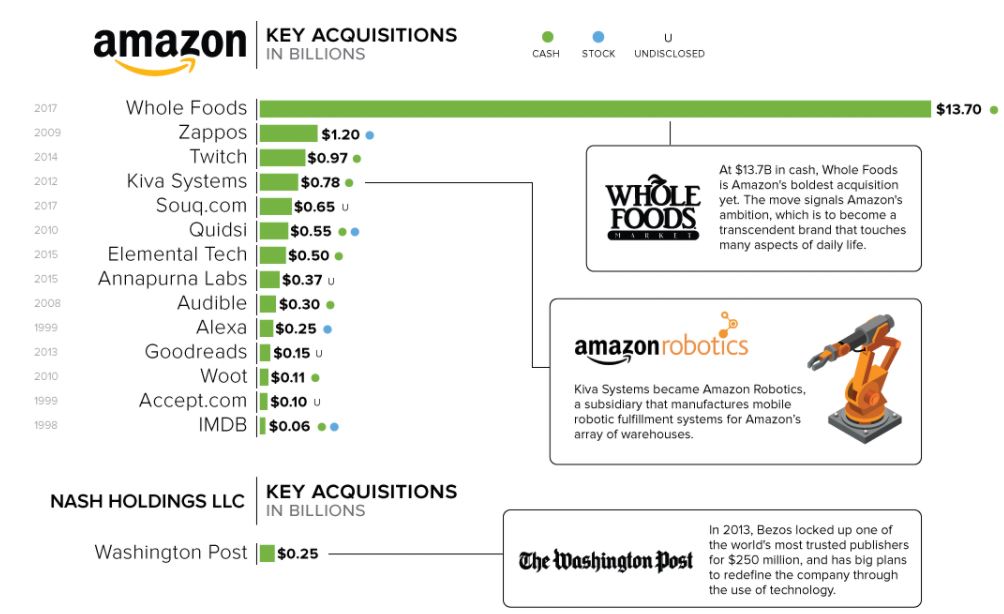

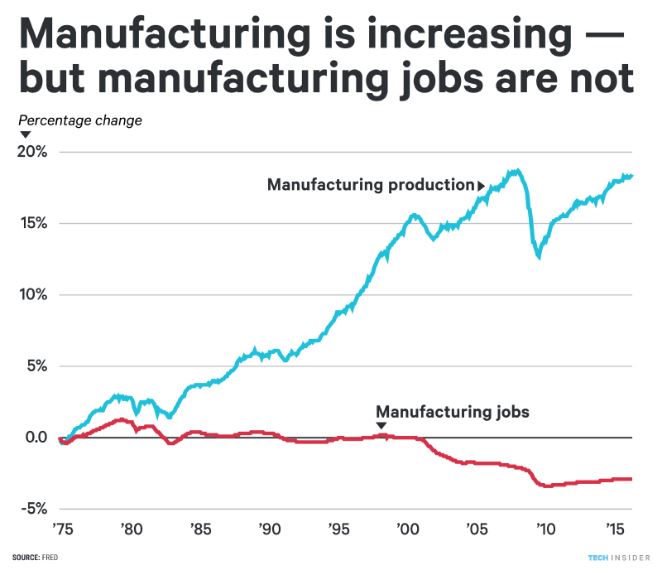

Automation is still very much core to the global manufacturing industry and the way we think about automation’s impact on the sector has expanded to include emerging technologies like AI, as previously discussed.

There is concern here in the United States, where 8.7% of American jobs are in manufacturing, that automation is displacing jobs in the short-term. Incumbent workers are upset because this shift will take time and will disrupt their way of life. After all, it took ~60 years for the English Industrial Revolution to improve the wages of work (although, that was before the age of the internet which has made re-education accessible and affordable for the masses).

Furthermore, some Chinese manufacturers have successfully reduced up to 40% of their workforce as a result of automation and are even opportunistically shifting labor costs to cheaper surrounding economies.

The reality is that manufacturing jobs are not the only jobs at risk. (Beyond traditional industrial robots, collaborative robots are already making their way to a workforce near you!) In time, machines and computers will directly augment or replace every job across every vertical.

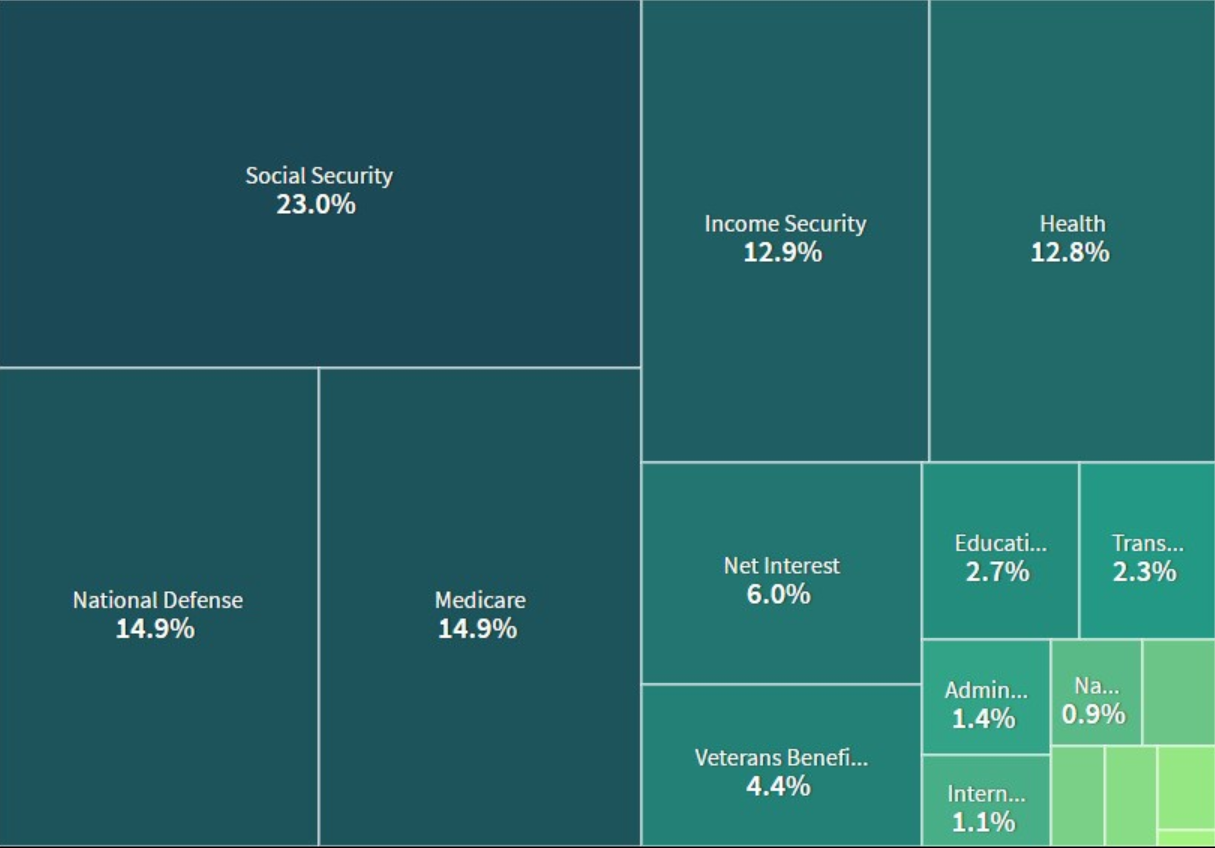

As the rate of technological automation increases, I personally believe that the displaced labor force would benefit from structured or subsidized unemployment to help workers transition between jobs. Workers today transition from job to job much more frequently than 100 years ago and the half-life on a given skill required for a specific job is shortening. As such, job security (or rather income security) will continue to be a relevant discussion point. Darrell M. West, thought leader at the Brookings Institute, suggests that we should consider new paradigms in our social contract with society which encompasses everything from basic income (for purposes of retirement and healthcare), to separating our benefits from jobs, and even offer learning assistance to those who are looking for a job.

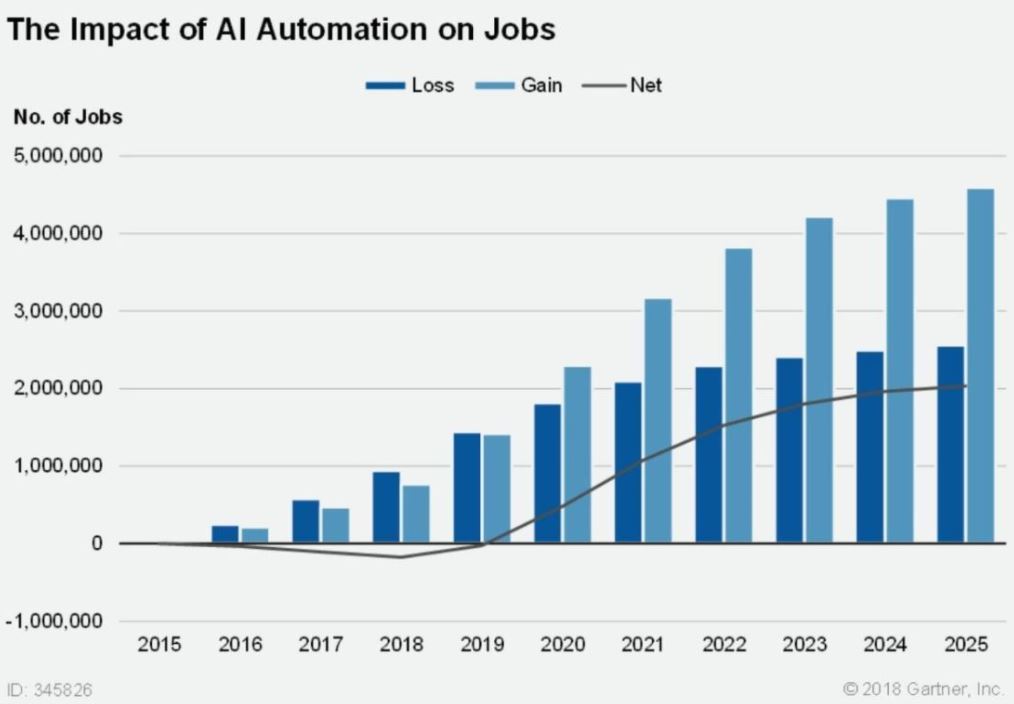

Long-term, the picture brightens. Sources ranging from Gartner, the World Bank, and leading economists all agree that automation will produce two broad-sweeping benefits for society:

- Jobs will shift towards higher-skilled work and thus an increase in wages will follow.

- The number of total jobs added to the workforce will increase at a faster pace than the number of jobs displaced.

It should not go unstated that there are some who have dystopian expectations. Those who find themselves in the same camp as Alvin Toffler, author of Future Shock (1970) and well-known futurist, would suggest that an increase in wages may not follow the shift towards higher-skilled work since the skills baseline is continuously being raised. Toffler and others posit that automation could actually result in more and more people being left behind as jobs become increasingly complex. It’s worth noting that over the years, a portion of these voices have converted to the utopian perspective which equates automation with an increase in higher-skilled jobs.

Regardless of which side proves to be correct, as automation takes hold long-term, education and augmentation technologies will continue to be crucial tools for workers. I plan to elaborate on specific automation investment theses in future posts.

Living in an Automated World

Today, automation is truly industry agnostic and impacts every aspect of our present-day lives from mobility services to job recruiting. As the pace of automation increases there are many social questions that remain unresolved:

- How should we think about the way we define “work” in a world where there may be less work (in the traditional sense) to go around?

- Does a 30 hour work week make sense?

- Should there be renewed emphasis on parenting, volunteering, and giving back to the community?

- How do we remedy automation’s negative side effects such as increased carbon dioxide emissions?

- How quickly/slowly willy automation affect each industry vertical?

- etc.

Automation will increasingly play a role in empowering the progression of society. Being a realistic optimist, I believe that we should embrace automation. Every person should be free to strive towards his/her own definition of enlightenment, fulfillment, or even pursue uniquely human thought – the arts, sciences, philosophy. Basic necessities will be provided by closed-loop systems. Autonomous vehicles will offer real-time transportation anywhere. The endgame for automation is not realized until the automation of all work has been accomplished and the pursuit of learning together with one’s personal interests is a luxury anyone may access anytime.

If you share this vision of an automated world or are working to address challenges in this field, let’s chat!