A Personal Note

Although the days of my youth competing in LAN tournaments have sadly long since faded, I still enjoy keeping up with the gaming industry in the capacity of an enthusiast. One to two hours of actual game time a month signify a “win” by my present-day standards. My recent industry exposure has been more professionally inclined including 1) white papers covering mobile gaming and gaming in AR/VR/MR, 2) supporting the Havok acquisition during my time at Microsoft, and 3) the occasional video game conference trip with friends. With E3 2018 already upon us, this last point seems particularly relevant… There’s a story worth telling regarding an incredibly uncomfortable E3 road trip in a Tesla from Seattle to the Los Angeles Convention Center but I’ll save that tale for another time.

A friend at Andreessen Horowitz (a16z) recently asked that I share some of my knowledge of the eSports industry with one of his fellow partners. Given my interest in the space, I decided to explore below a few of the points I brought up with him during the conversation.

What is eSports?

My thesis as to what defines an E-Sport boils down to several key components that are mostly in-line with industry consensus. These components have analogues in traditional sports, but achieving them in the eSports scene presents unique challenges:

- Publishers/Games: Accessible and appealing games are at the core of the eSports industry. They are designed with both the casual and hardcore gamer in mind. Generally speaking, a good eSports title is one that new entrants can pick up but requires a significant investment of time to master.

- Community: Games that achieve a critical level of adoption witness the emergence of connected audiences across social media platforms including Youtube, Facebook, Twitch, and Discord. Video, specifically streaming, has been a game-changer for community building thanks to real-time interactions opportunities they offer community members. Several cross-game eSports social communities have come and gone but none of them seem to have long-term staying power. This is likely due to the fact that social communities for each eSports game feature unique cultural norms and happen to be fairly well isolated from other communities. To elaborate, Smash Bros. Melee and Dota 2 communities have about as much in common as hockey and NBA fans. Fans typically stick to their respective swim lanes.

- Competition: As a game’s community evolves, teams, events, and tournaments form. Individual players and personalities gain notoriety. Winners and losers are showcased through local, national, and worldwide levels of play. Compared to the career of a traditional athlete, professional eSports careers will likely have a much shorter life span considering that 1) new games will replace old games, 2) the fundamental rules of a game change every time a new character or rebalancing patch is released, and 3) skills required for the upper echelons of competitive play are not very transferable to other games. As a result, building long-lasting stories about individual competitors and teams that resonate across eSports communities may be difficult. Legacies built in traditional sports can last decades and are relatable to fans across generations. When a traditional sport like basketball or baseball hits the big time it has staying power and rules governing those games rarely change.

- Incentives: Players become competitors when a prize is at stake. Beyond sheer appreciation for a game, money, swag, or claim of title give players reasons to keep coming back.

- Brands: Brands are the enablers of those incentives. Consumers vote on players/teams with their viewership and brands follow the underlying consumer install base. A larger install base ultimately leads to a larger opportunity for monetization.

It’s important to note here that eSports are platform agnostic- gamers play across mobile, console, and desktop devices.

eSports Market Overview

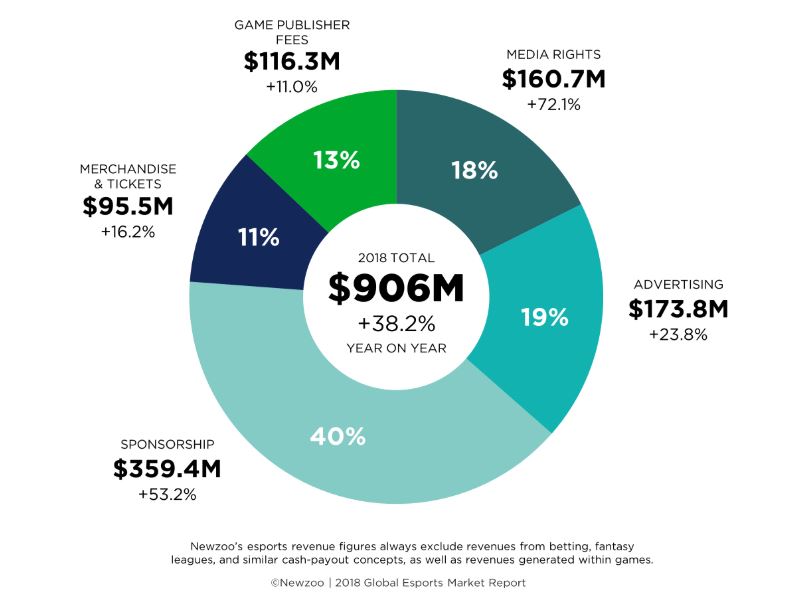

- In 2018, eSports will grow to $906M, up 38% YoY.

- Brands will contribute 77% of this, or $694M, a 48% increase since last year.

- The global eSports audience will reach 380M this year.

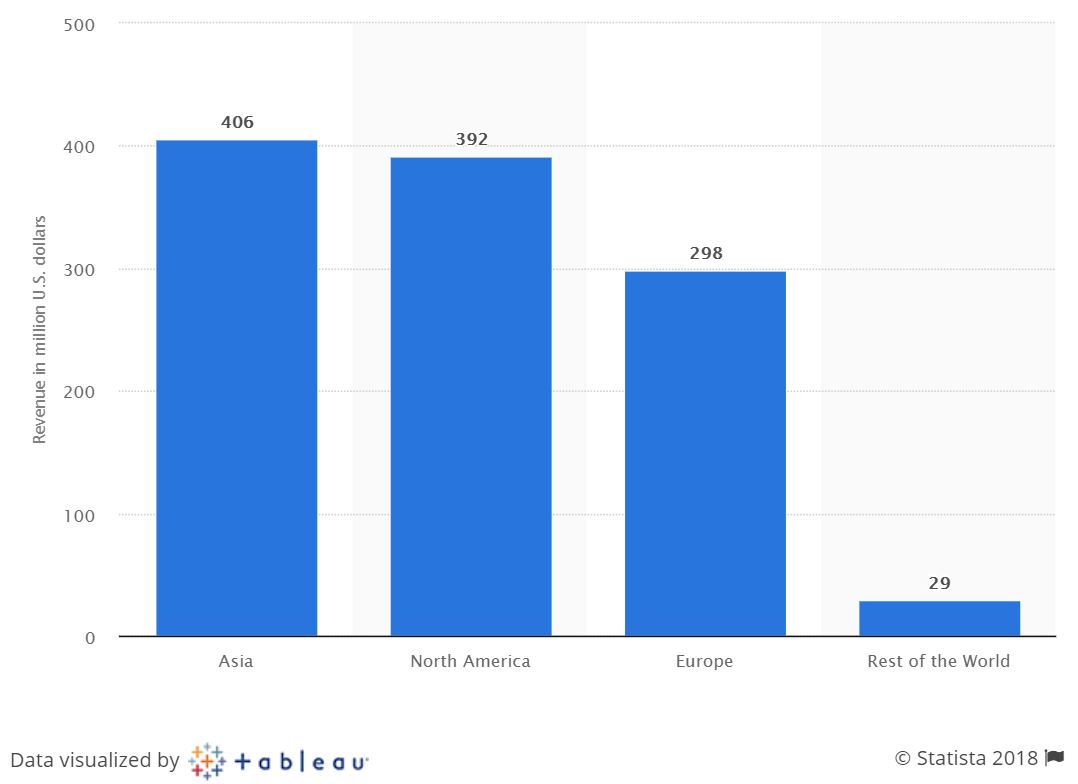

- Asia ($406M) and North America ($392M) lead the market in revenue generation.

2018 eSports Global Revenue Streams

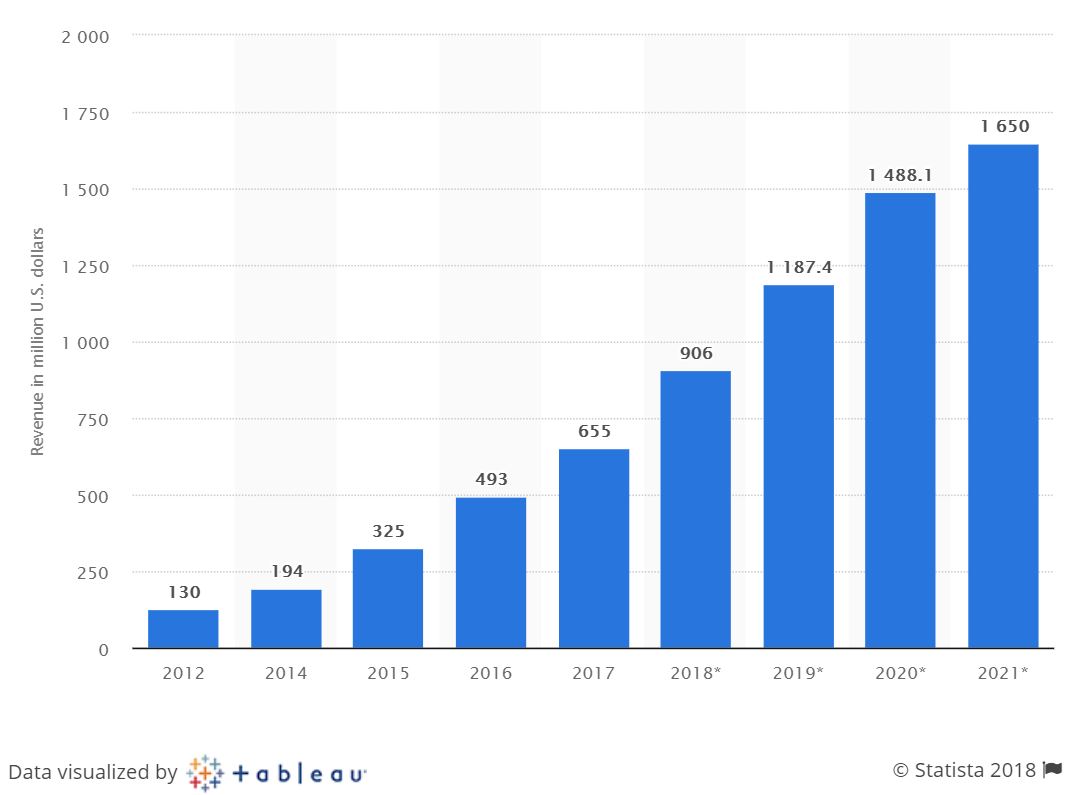

eSports Market Revenue Worldwide ($M)

2017 eSports Global Revenue by Region ($M Est.)

Trends and Industry Themes

- Occasional Viewership is Growing: While “Enthusiasts” continue to expand the market, “Occasional Viewers” are equally important in driving overall viewership. When you think about it, those “Occasional Viewers” have a lot of options as to how they want to spend their free time. It’s impressive to see that people are increasingly choosing to engage with eSports over the latest Westworld episode or even alternative activities like hiking and traveling. Catalysts driving this trend arguably stem from accessibility and the economics of the industry. Compared to a live Warriors game, watching professional eSports competitors like Mango and Mew2King duke it out over a stream is practically free. The barrier to entry for viewers is really quite low since you really just need a device and internet access.

Global eSports Audience Growth

- The Rise of Free to Play (F2P) Games: F2P games have introduced a business model paradigm for the industry. Most industry spectators would agree that F2P games with in-game microtransactions for skins, loot boxes, exp boosts, etc. seem to be the future of gaming. The F2P model has successfully been applied across gaming genres including Multiplayer Online Battle Arena (MOBA), Real-Time Strategy (RTS), First-Person Shooter (FPS), Battle Royale,…

- eSports Expands to the West: Asian audiences may remain the largest segment of the market but there is a fast-growing Western audience. While I want to refrain from going deep on eSports history, factors that accelerated Western audience adoption include:

- 2009 gaming regulation in South Korea and the decline of StarCraft opened the door for other countries and games to take center stage.

- Dota 2 and League of Legends competitions were important drivers for Western audience eSports adoption. A documentary called “Free to Play” does a great job giving you a sense of what it felt like to be an eSports competitor in the early days of Dota 2.

- Prize Pools Legitimize eSports: Just five years ago a $1M prize pool was practically unheard of. Last year, Dota 2 tournaments paid out nearly $38M and Epic just announced $100M in prize money for Fortnite tournaments this year. Prize pool expansion correlates tightly with traction in mainstream popularity and numbers like this demand attention.

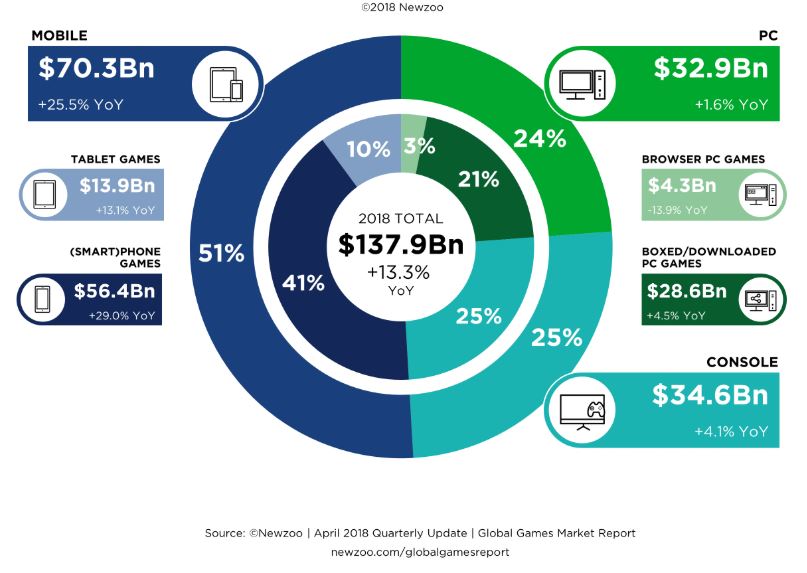

- Mobile is King: Compared to consoles and the PC market, growth in the mobile ecosystem is unparalleled. Tencent reigns supreme in mobile gaming while Android and iOS still manage to capture 30% of every transaction that goes through their respective platforms. As device form factors converge, mobile will continue to expand its influence in the gaming industry and likely impact the future of eSports.

2018 Global Gaming Spend by Device ($ and %)

Where are the Pockets of Growth in eSports?

While most of the money in eSports is courtesy of B2B advertising or in team/event sponsorships, there are a few areas of the market that I anticipate will generate value in the mid-long term:

- eSports “Holding Companies”: There are several organizations in the industry that act similarly to Berkshire Hathaway. They manage a portfolio of teams across games that are comprised of a rotating roster of professional-level talent. These organizations are magnets for branding dollars. Tangentially, AAA game publishers are acquiring smaller game publishers to consolidate (and in some cases refocus) game developer talent.

- Media Rights: Exclusive rights to tournaments and games will be big money partnership opportunities for distribution platforms. In January, Twitch announced that it had signed a $90M deal with Blizzard to stream the first two seasons of the Overwatch League. How long before traditional media distributors enter the market?

- Streamer Enablement: I think of this as the tools layer of the eSports stack. What intelligent video snipping tool or innovative communication tool will simplify the life of a streamer?

- Betting/Gambling: The Supreme Court recently struck down a federal ban on sports betting so expect to see a wave of eSports betting companies. Betting was actually pretty big abroad through AlphaDraft and similar platforms but wasn’t available to domestic speculators until now.

- Hype Generators and Sponsored Merchandise: As mentioned earlier, eSports communities are disconnected and, as such, there really isn’t an ESPN equivalent that serves as a primary source of coverage for the industry. Additionally, there is opportunity for resellers and OEMs to step up their game with branded merchandise.

Conclusion

eSports titles have experienced extraordinary progress towards becoming household names in recent years and I’m excited to see how the space develops. Up-leveling the conversation to the broader gaming industry, I’ll continue to be keeping an eye on the mobile ecosystem and Gaming as a Service (GaaS) in addition to eSports. Additionally, any solution that connects gamers to other gamers or their games merits attention regardless of whether in the software or hardware layer of the stack. With that said, personal opinions and industry observations should not be interpreted as investment advice.

I’m looking to improve my understanding of the economics behind eSports teams/tournaments/leagues. How about you? Do you have any thoughts around eSports trends or companies in the space?