A Personal Note

In the spirit of making the most of my time in Europe, I’ve lined up a fair amount of travel in June including stops in Venice, Florence, Cinque Terre, Pisa, Lucca, Milan, Lago Maggiore, Barcelona, Madrid, and London. If you have any food, sight-seeing, or must-do recommendations, let me know!

As some of you noted, there was a problem with the email subscription button when I launched my last post. If you still have issues trying to subscribe, please let me know.

AR/VR/MR

- Unity raises $400M from Silver Lake. Two-thirds of all AR/VR content and half of all new mobile games (including Pokemon Go) run on Unity. Being platform agnostic, Unity claims a defensible moat against secular trends within the gaming industry. I fully anticipate that companies like Unity and Improbable will institutionalize a new market over the next decade as massive scale simulation environments traditionally built for gaming purposes are applied to big ideas including city planning, transportation, and the very economy as we know it.

- HTC announces Link, a VR headset that connects to the U11 smartphone. Why didn’t HTC use the Vive brand? Perhaps, HTC is making an effort to differentiate branding for the mobile-phone and tethered experience? This comes off of Google’s announcement to work with HTC to create a standalone Daydream headset so it’s somewhat unclear what HTC’s intentions are at this point.

- Hasbro partners with DMG to create AR/VR experiences around Transformers. We’re witnessing the comeback of the arcade. The Imax VR arcades have received positive review.

- You won’t need your prescription glasses to use future head-mounted displays.

- Microsoft showcases it’s “near-eye” glasses and reveals more Windows Mixed Reality headsets at Computex.

- Chinese consumers aren’t meeting VR adoption expectations.

- MLB unveils its VR experience.

Cryptocurrency

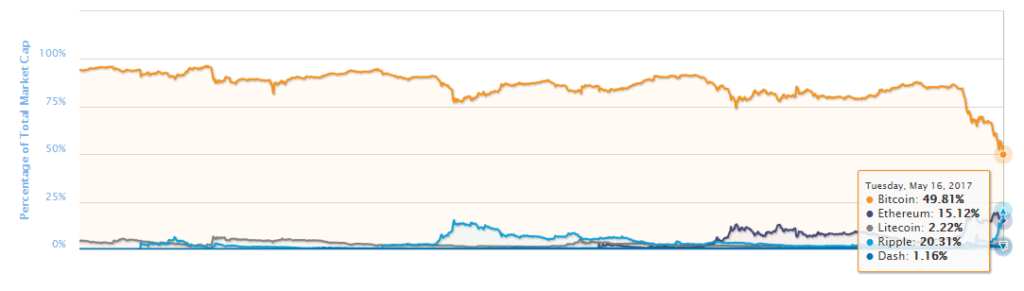

- All aboard the hype train! When Fortune releases a Bitcoin 101 video after BTC adds billions more to its market cap, you know it’s a mainstream phenomenon. More recently, Bitcoin has witnessed a pullback while Ethereum continues its growth trajectory. Brace yourself for more volatility. Recent catalysts driving cryptocurrency adoption include capital inflowing from Japan and China, the recent Ethereal Summit, Bitcoin Scaling Agreement, Japan legalizing Bitcoin, Coindesk’s Consensus 2017, and Brian Kelly’s comments around buying cryptocurrency as a hedge against “political chaos”. Way to feed the flame, Brian.

- Since Congress announced the launch of the Congressional Blockchain Caucus in February, it seems like there has been a serious effort on behalf of the federal government to consider ways that blockchain technology will improve society, including specific applications like organizing medical records and even preventing IRS fraud. As awareness grows and governments around the world acknowledge blockchain technology, many are curious as to how regulation will affect this market. I believe the cryptocurrency market is overdue for limited oversight and that some regulation will positively impact adoption given the perceived Wild West nature of this space. To illustrate this point, there is little preventing issuers from walking away with your money after an initial coin offering other than faith and the promise of asset appreciation.

- R3 CEV, which provides an open-source distributed ledger platform for recording, managing, and automating legal agreements between businesses, raises $107M from 40 banks. For this industry, that’s a large pool of capital to be fundraising.

- For those who want to invest in cryptocurrency and haven’t yet made the jump, click this link to access my referral page and get $10 worth of Bitcoin when you sign up. If you’re an accredited investor, consider Coinlist which allows you to invest in early protocol tokens like Ethereum and Auger.

AI

- The TensorFlow Research Cloud announced at the Google I/O conference represents 1) an expansion of what is already the world’s most widely used deep-learning framework and 2) is a serious encroachment on Nvidia’s GPU accelerators for training machine learning algorithms. What would require a full day of training on 32 of the best GPUs can be done in an afternoon using one-eighth of one of its TPU Pods. See more highlights from the conference in the “Google I/O” section below.

- Apple is building its own AI chip which will improve battery performance by offloading AI processes from the main processor and graphics chip. Qualcomm and Apple are both making dedicated AI chips for the phone while Google and Nvidia sell similar chips to cloud customers.

- “Processing AI on devices is the new battleground for mobile companies, and it’s one area where Apple, at least for now, may be ahead of Google.” – Kevin McLaughlin

- Google launches an AI investment platform separate from Google Ventures.

- Frank Chen discusses cool AI projects. A company called Jukedeck is building an AI that makes music. Another project has an AI create pictures based on a text description. Who says AI is incapable of creativity?!

- Zillow launches a crowd-sourced machine learning competition to improve its home value algorithm. This will serve as a case study for others wanting to integrate machine learning into their software platforms. Most companies that are serious about improving AI presence in their stack acquire talent vs. outsourcing.

- Tech giants acquired 34 AI startups in Q1’17. Google has had the most activity, acquiring 11 since 2012, followed by Apple, Facebook, and Intel.

Stocks and Startups

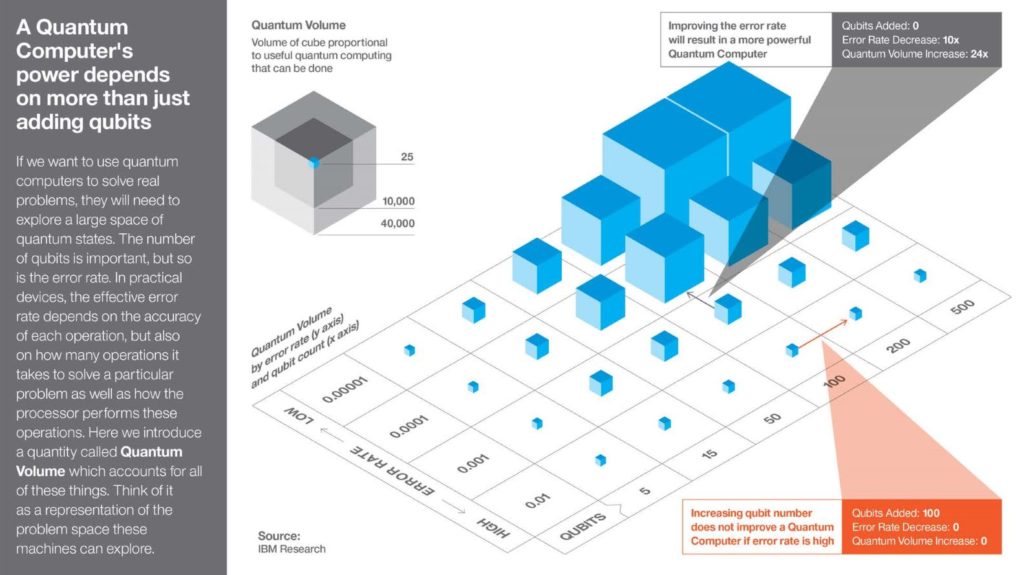

- IBM takes the lead in quantum computing with a new 17 qubit model available via IBM Cloud. It’s last generation quantum computer launched in May 2016 and had 5 qubits. 50 qubits is expected to surpass capabilities of todays’ computers. There are many different approaches academic institutions and companies like IBM are taking to create the quantum computer. Since the legendary Warren Buffett just sold off 1/3 of his position in IBM, it makes me wonder whether the Oracle of Omaha has some insight into Big Blue’s realistic prospects in being the first to 50 qubits.

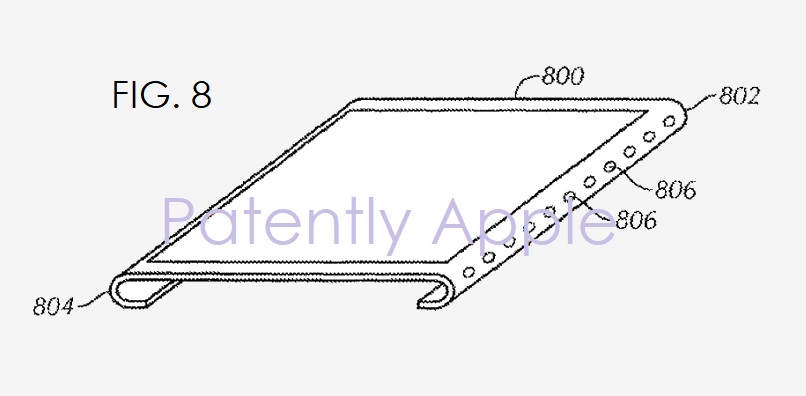

- Apple has been hinting at new products for some time and it seems that we may see one of them hit market sooner than later. Apple has a team working on the “holy grail” of diabetes and Tim Cook was apparently spotted wearing a device connected to his Apple Watch that tracks his blood sugar. In other news, the company may soon extend it’s influence beyond the phone+OS+app ecosystem into 5G mobile broadband services that have traditionally landed on the backs of telecoms like Verizon and Sprint. Last month, the company hired a pair of Google satellite executives and joined the Next Generation Mobile Networks for 5G development. Perhaps by 2018 or 2019, Apple will bring to market its recently patented curved display featuring an embedded fingerprint sensor on Apple’s 5G network? It’s always fun to speculate.

- Amazon aims to disrupt yet another market- pharmaceuticals.

- “Amazon is the data company that, to me, is the world’s greatest startup. All they’re doing is leveraging their data to build more startups.” – Mark Cuban at the Lerer Ventures CEO Summit

- Wal-Mart digital sales jump 63%. What’s impressive is that the growth in online sales isn’t stealing away its retail store customers, as in-store traffic grew again. Contrary to popular belief, Wal-Mart’s e-commerce strategy may still have a horse in this race.

- After loosing the NFL deal to Twitter, Facebook has turned towards live-streaming for the MLB and has announced a broadcast partnership with esports league ESL. Facebook has also signed deals with a number of millennial-focused brands including Vox Media, BuzzFeed, ATTN, Group Nine Media.

- Despite continued negative press around sexual harassment, Travis Kalanick admitting he needs leadership help, and the latest round of news from the lawsuit with Waymo, Uber still remains a company people really want to work at. Are we, the tech labor force, effectively affirming that we hold vision and ambition in higher regard than ethics? Perhaps, the media is to blame for over-scrutinizing behavior at Uber? Culture is merely the summation of the people that make up an organization and leaders, which guide those organizations, have the responsibility of setting a positive pro-equality example for their workforce. No leader will have the comprehensive set of desired traits but when he (or she) realizes they’re not up to the task of managing an organization that impacts the lives of millions of people, it’s time to find someone who is.

- After much negotiation, Microsoft is rolling out a custom version of Windows for the Chinese government. China was one of the worst hit by the WannaCry ransom attack due to the high rate of pirated Windows 7 software in the country. If you recall, 97% of computers infected were using Windows 7. When I lived in China as a foreign English teacher, each classroom in all five schools I taught at ran on some kind of pirated version of Windows. If memory serves, “GhostWin7” was the most common fake Windows boot screen title. In electronics stores and repair shops, I frequently saw fake copies of Office for less that $2.

- Facebook’s Mark Zuckerberg delivers a commencement speech at Harvard. Also entertaining were the student newspaper’s headlines.

- SoftBank took a $4B stake in Nvidia. Nvidia has some ground to cover to match Google’s new TPUs. One must question just how much of an impact the Berkshire Hathaway of tech will have on late-stage funding rounds as capital continues to flow upstream. SoftBank closes $93B for its Vision Fund as startup valuations are in alignment with their 13 year averages after having fallen from highs in 2015.

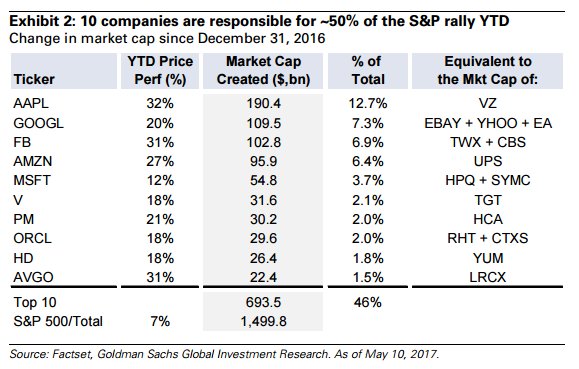

- Quarterly earnings growth appears healthy. I’d be interested in seeing analysis around how much of this is attributed to top-line growth vs. cost-cutting.

- 58% of PE firms expect to fire inherited CEOs within two years.

- Uber and Lyft return to Austin. When Uber left the city, a sketchy Facebook group popped up that connected riders with unverified drivers. I heard some crazy stories from friends who used the group including one where the driver locked the doors until my friend doubled his tip.

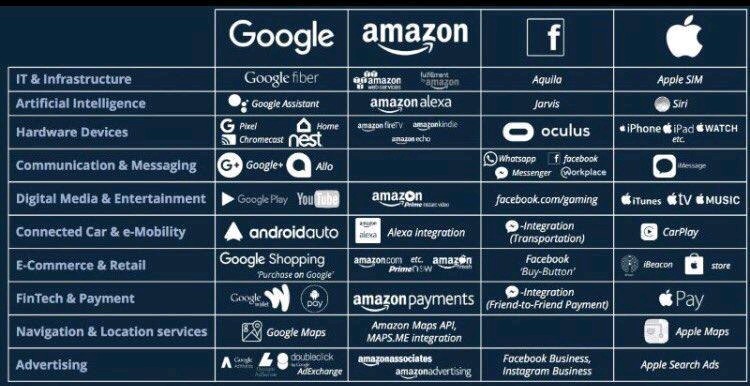

- Tech giants on their way to global domination:

Google I/O

- Lots of conversation and opinions on this already. Here are some of my favorite links:

- Everything going on at day 1 of the Google I/O conference.

- Ben Thompson discusses some of Google’s new products in Boring Google.

- Comparison between Google I/O and Microsoft Build.

- Google Assistant will make money from e-commerce.

- Google Lens turns your camera into a search box.

- Actions on Google lets developers use Assistant.

- Google Home will have free calling. This move was expected as Amazon’s Echo and Microsoft’s Invoke now offer free calling and Skype calls respectively.

- YouTube VR adds shared rooms and voice chat.

- Android reaches 2B active installations vs 1.5B PCs running Windows.

- Android O beta is open and Google announces Android Go for cheap phones.

Products

- Andy Rubin’s company Essential releases its new Android phone. Essential also announced a smart assistant device and clip-on phone camera. Verizon, T-Mobile, Sprint, and AT&T will all support the phone.

- Microsoft launches an updated Surface Pro. Microsoft also offers the Surface Laptop at $999, the Surface Book at $1,499, and the Surface Studio at $2,999. Last quarter’s Surface revenue came it $831M vs. Apple’s $5.8B. We still have some catching up to do, especially after last quarter’s 26% drop in Surface revenues, but public consensus seems to agree that the Surface Pro is a solid machine.

- Nest has a new camera that can tell the difference between residents and strangers.

- mssg.me allows users to keep messages from across apps in one platform.

- Robosea is a wireless underwater drone.

- Interactive AR windows are here.

- The copy-cat game continues as Instagram introduces face filters and launches Direct.

- Weibo is bigger than Twitter:

- Medium offers narrated posts for paid members.

- Google begins selling Jamboard in the US.

- Ikea’s smart light system to be compatible with Alexa, Siri, and Google Assistant. Where is Cortana?

- The LIDAR battle.

Government and World News

- Net Neutrality and Privacy

- The FCC proposed rolling back net neutrality protections put in place under Obama. A final vote will take place in a couple months. To see the view from the other side, read a few arguments against net neutrality. I believe that an open and fair internet is a fundamental right. If you value your access to the internet and enjoy watching “goats singing Taylor Swift songs“, I would urge you to take action by sharing your opinion with the FCC at gofccyourself.com.

- 2016 U.S. exports:

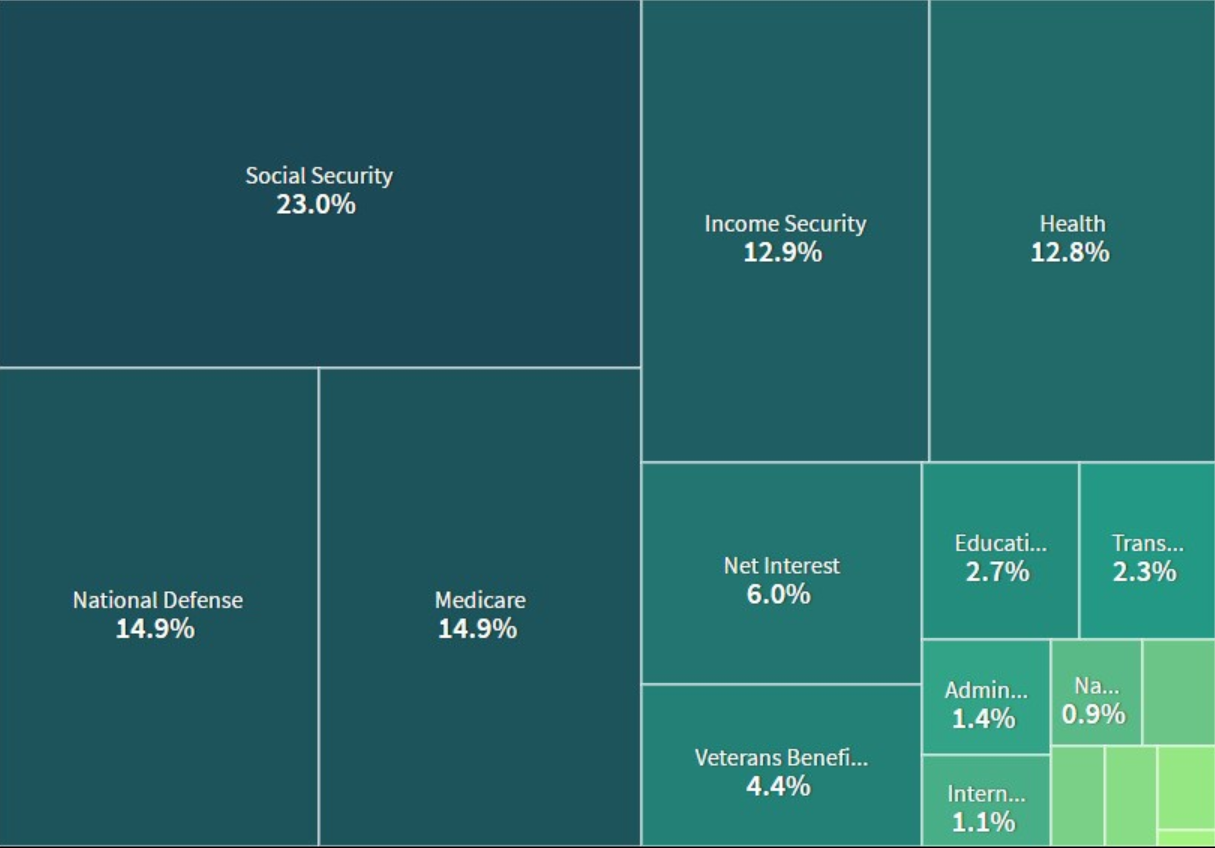

- The Federal Budget

- Trump promises to balance the budget within a decade by increasing spending on military and border security while cutting off access to food stamps, jobs for vets, and student loan subsidies. Not to mention the $2T accounting error.

- The Federal Reserve

- The Fed will raise rates “soon”. No update on a target for the $4.5T balance sheet but markets reacted positively.

- OPEC

- OPEC agrees to extend production cuts into 2018 but investors were disappointed that OPEC did not take a more aggressive measures. Goldman expects oil prices to stay around $50.

- NAFTA

- Instead of walking away from NAFTA, it looks like the U.S. will sit at the negotiation table in August.

- NATO

- Trump was silent on Article 5. NATO is weakening and the U.S. is viewed as an entity that cannot be relied upon.

- TPP

- The 11 remaining members will pursue a trade deal without the U.S.

- “Bilateral negotiations are better for the U.S. than multilateral negotiations.” – U.S. Trade Representative Robert Lighthizer

- The 11 remaining members will pursue a trade deal without the U.S.

- Saudi Arabia

- China and Hong Kong

- The Bond Connect program, which connects international investors with China’s $9T bond market, has been formally approved. Meanwhile, Moody’s has lowered China’s credit rating to A1 from Aa3.

- In a “freedom of navigation” operation, a US battleship challenged Beijing’s claim in the South China Sea. If this was an attempt to give allies in the region a boost of confidence, it seems like too little too late. China announces it will modernize its Navy. This all comes as China continues to expand artificial islands in the South China Sea and as the U.S. urges China to pressure North Korea on its missile program. China’s import of North Korean goods have fallen and the country’s Foreign Minister publicly asked North Korea to “not do anything again to violate U.N. Security Council resolutions”. North Korea ignored this advice and launched another missile test. Japan and South Korea have promised “concrete action” and “strong punishment from our military”. The situation does not look good.

- Japan

- Private consumption is finally kicking into gear resulting in Japan’s longest growth streak in a decade.

- Germany

- Trump says “the Germans are bad, very bad” for contributing to a lopsided trade surplus and threatened a 35% import duty for foreign built cars sold in the U.S. Considering that Germany’s main export product is the car and that the U.S. is Germany’s largest trading partner, it’s no surprise that Angela Merkel recently came out saying that Europe can no longer rely on the U.S.

Video Games

- Microsoft is doing with Mixer (formerly Beam) what Facebook is doing with Instagram. Compared to Snapchat, Instagram is more convenient given its proximity to and clean integration with Facebook’s social platform and Instagram has been rapidly improving the end-consumer experience through new (and sometimes unoriginal) features. Similarly, when compared to Twitch, Mixer will be more accessible to gamers on the PC, mobile systems, and consoles. Additionally, it has the benefit of lower latency, co-streaming, and interactivity. The question here is whether or not ease of access and a better experience for gamers will result in install base shift. As much as I like Twitch, my (admittedly biased) bet is on Mixer.

- Supercell builds out its talent pool by acquiring 62% of British game developer Space Ape Games for $55.8M. This is Supercell’s second investment in two months and I’d like to hope they’re bringing in talent for something big. As mobile gaming developers are oftentimes dependent on the success of one big hit (similar to the pharmaceuticals industry), its not uncommon to see small teams breakout with very successful apps. Seeing the talent pool in the industry expanding, it makes sense that Supercell is looking to acquire upcoming shops before they become competitors.

- Epic Games’ CEO Tim Sweeney worries that industry giants will try too hard to own the platforms upon which those games are built, and that will lead to toll booths, a lack of open standards, and a loss of privacy. The industry is still developing and while this may not be an immediate concern, it’s never too early to raise awareness.

Music

- Spotify acquires Niland to improve music discovery and remain competitive with Apple and Pandora. There is speculation that the company will be going public soon and will soon compete as a broader media platform. This industry became quite fragmented in recent years and faced a tough period of declining sales as a result. It seems that more recently, competitors have been pushed out of the market on pricing, lack of content, or by acquisition. Apple Music, Spotify, and SoundCloud look to be fairly well positioned relative to their competitors and long-term I’m not sure that consumers will care to keep track of more than one or two services. My gut tells me that the industry is stabilizing. We’ll see how much more consolidation there is before the survivors are left standing.

- Pandora turned down an acquisition bid in July for $3.4B and is now considering an offer from Sirius XM for for just over half that amount.

Science

- 3D-printed ovaries allow infertile mice to give birth.

- Microbots and micromotors will eventually move through your body to perform medical tasks.

Self-Improvement

Noteworthy Findings

- Who wants to help me renovate a castle? For free. This actually kind of a serious question.

- Sotheby’s sold a pair of diamond earrings for $57M.

- A painting sold in 1984 for $19K just sold for $110M.

- PharmaBro Martin Shkreli is the subject of a musical.

- The average Lithuanian drinks the equivalent of 910 bottles of beer per year.

- A Chinese chemical company paid $1B for the maker of the Talking Tom app. Talking Tom is a cat that makes farting noises. I guess buying expensive apps is the new growth strategy for chemical companies?

- Dutch king reveals double life as an airline pilot.

- ColdFusion’s latest video talks about the history, scale, and influence of YouTube. I’d recommend skipping to 2:22.

- Walt Mossberg’s last weekly column for The Verge and Recode on the evolution of personal technology and ambient computing.

- The legendary Steve Cohen will be making a return as he seeks to raise $20B for a new fund launching in 2018. Steve Cohen has been operating under Point72’s family office structure since 2013 when SAC was forced to shut down due to allegations of the firm’s “black edge” practices.